irvine income tax rate

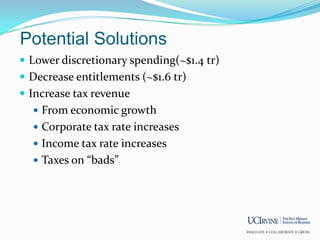

We already have the highest top personal income tax rate in the country but ACA 11 would make it even higher. Taxes in Irvine California are 102 more expensive than Brea California.

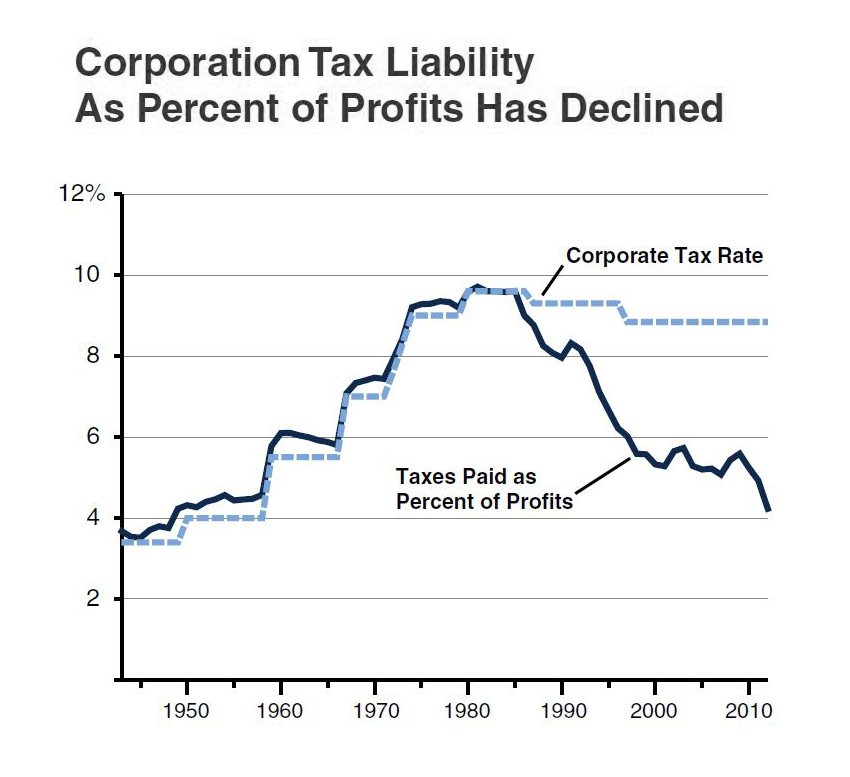

Corporation Tax Liability As Percent Of Profits Has Declined Econtax Blog

Property Tax Rates Listings.

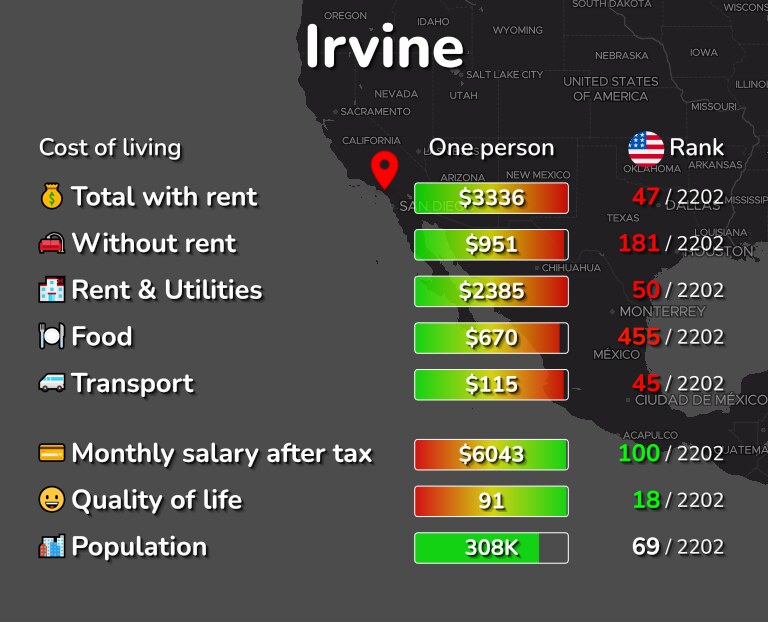

. The California income tax has ten tax brackets with a maximum marginal income tax of 1330 as of 2022. Cost Of Living In Irvine CA. The average cumulative sales tax rate in Irvine California is 775.

Taxable income Tax rate. OUR firm AT property TAX research group LLC is made UP of well qualified professionals WHO USE there expertise along. As computed a composite tax rate times the market worth total will reflect the.

First we used the number of households median home value and. The US average is 73. The US average is 46.

You and your spouse if filing jointly must be US. The minimum combined 2022 sales tax rate for Irvine California is. The California sales tax rate is currently.

Detailed California state income tax rates and brackets are available on this page. As calculated a composite tax rate times the market value total will provide the countys entire tax burden and include your share. East Irvine Irvine City Sales Tax.

The US average is 46. In this basic budgetary undertaking county and local. Orange County Property Tax.

Irvine City Sales Tax. Orange County Sales Tax. California State Sales Tax.

The state income tax rates range from 1 to 123 and the sales tax rate is 725 to 1075. Future job growth over the next ten years is predicted to be 402 which is higher than the US average of 335. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is the highest state income tax rate in the country.

The minimum combined 2022 sales tax rate for Irvine California is. There is an additional 1 tax on taxable income over 1 million for mental. Look up 2022 sales.

Property Tax Assessment Appeals Deadline Extended And Remote Hearings Allowed For California Property Tax Purposes Effective S Tax Attorney Property Tax Tax Fha 500 579. If you earned less than 58000 in 2021 you may be eligible to receive Earned Income Tax Credit EITC worth more than 6700. The 92618 Irvine California general sales tax rate is 775.

Expect to pay between 1715 in rent for a. The state income tax rates range from 1 to 123 and the sales. Tax Rates for Irvine The Sales Tax Rate for Irvine is 78.

This is the total of state county and city sales tax rates. Once market values are assessed Irvine along with other in-county public units will calculate tax rates alone. Our CFO and Accounting firm is located at 17575 Harvard Ave C740 in Irvine CA.

Irvine has seen the job market increase by 06 over the last year. The California income tax has ten tax brackets with a maximum marginal income tax of 1330 as of 2022. 2600 Michelson Dr Ste 1700.

California is known for high taxes and Irvine is no exception. The average cumulative sales tax rate in Irvine California is 775. The state imposes a 6 sales tax rate and Orange County applies another 025.

The Income Tax Rate for Irvine is 93.

Section 962 Election Of The Corporate Tax Rate By Individuals Trusts And Estates For Global Intangible Low Taxed Income Gilti Income Inclusions Thomas Ppt Download

Why You Need To Know Your Taxable Income Before Tax Loss Harvesting

California Income Tax Calculator Smartasset

Sales Tax In Orange County Enjoy Oc

Effective Tax Rates How Much You Really Pay In Taxes

California Sales Tax Calculator And Local Rates 2021 Wise

2020 Tax Brackets Deductions Plus More Hbla

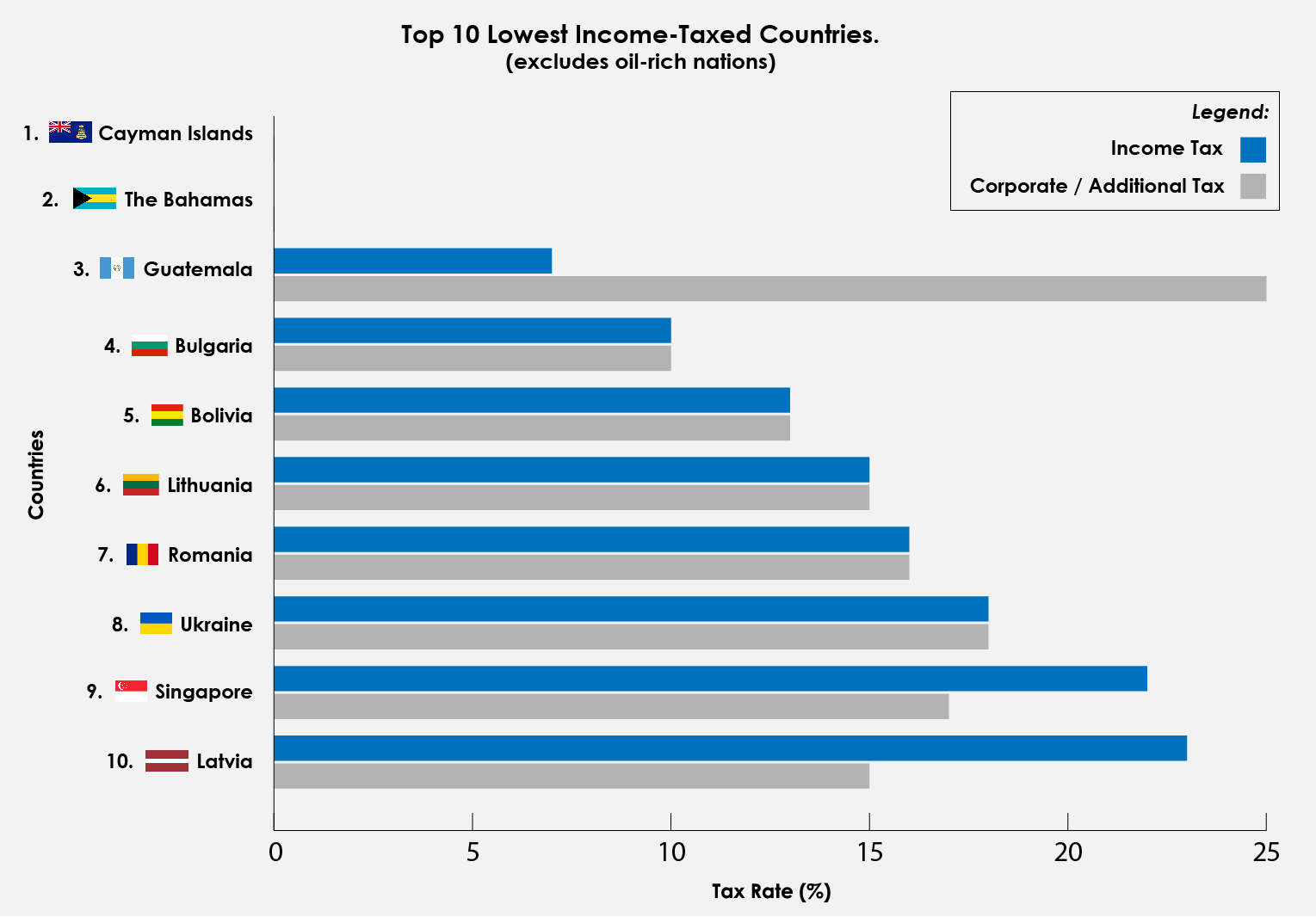

Does Lower Income Tax Make A Happier Country

Can The U S Cut Child Poverty In Half In A Decade Econofact

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Complying With New Schedules K 2 And K 3

Overview Of The Individual Provisions In The New Tax Reform Act Draffin Tucker

Understanding California S Property Taxes

Cost Of Living Prices In Irvine Ca Rent Food Transport

How Tax Diversification Can Improve Your Odds Of Success

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Uc Irvine Business Outlook 2011 Presentation

Pdf The Effect Of Corporate Tax Avoidance On The Cost Of Equity